Inside the Aluminium industry: a Textbook case of sustainability oriented content

Executive Summary

- Aluminium is everywhere, from your fridge to your car.🚗- This B2B industry has huge potential of sustainable impact.

- ESG is core to the sector = 60% of the overall online content. Never seen before!

Key insights:

- Very focused: Only 3 environmental topics = 90% of ESG content.

- Engagement is super low

- Social aspect is nowhere: Opportunity to attract talent.

- High net sentiment BUT low engagement: missed opportunity to leverage good stakeholder's sentiment into business operations.Want to know more? Read below! ⬇️

High volume of ESG content

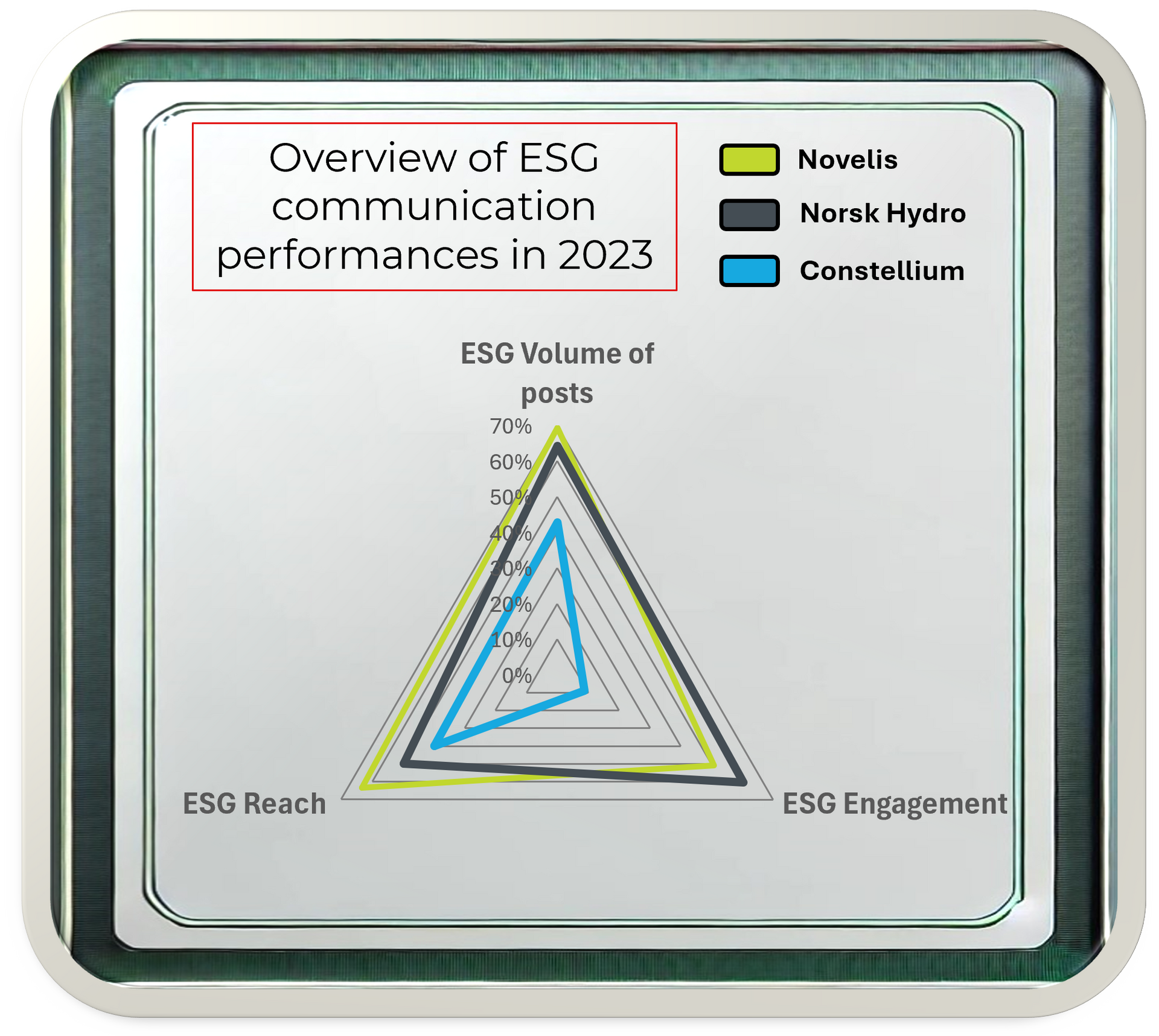

The data show that contents mentioning companies in the aluminium industry is overwhelmingly focused on their ESG actions. For Novelis, ESG topics in 2023 represents 69.4% of its online presence. Norsk Hydro follows closely behind, with 64% of its posts, while Constellium, although weaker, still have a solid 43% of its content to ESG-related themes.

To put this in perspective, the volume of ESG posts in the aluminium sector far exceeds that of other industries. For example, our research on the coffee sector showed an average of just 12% ESG-oriented posts (you can have a look at it here!). This striking difference underlines the strategic importance attached by the aluminium sector to sustainable development, making it a Textbook case of ESG-focused communication.

Engagement: a mixed picture

While the volume of ESG posts is uniformly high, engagement levels tell a more nuanced story. Norsk Hydro leads the way in terms of audience interaction with ESG content, by having an engagement rate of 60% of the overall engagement. If we compare this rate to their volume of ESG posts (64%), we see that ESG content achieves fairly similar performance as non-ESG content in terms of engagement.

Novelis follows with 50.7%, indicating that more than half of their total engagement is generated by ESG content, which compared to volume (69%) shows a real lack of engagement with ESG content. Constellium is clearly lagging behind, with only 9% of its engagement coming from ESG posts. This poor performance shows a real missed opportunity for them to engage and leverage the interest of their stakeholders.

This disparity suggests that if Norsk Hydro succeeds in achieving similar engagement as non-ESG content, Novelis, and more particularly Constellium approach to ESG communication may be falling flat. The low level of engagement can be attributed to several factors, but it is indicative of a real missed opportunity.

Reaching with ESG: the challenge of a wider audience

The reach of ESG messages, i.e. the visibility they generate, also varies from company to company. Novelis stands out by achieving an ESG reach of 63.3%, meaning that its ESG messages do indeed reach a wide audience, slightly less than the volume devoted to ESG content, indicating that non-ESG content could reach slightly more people here. Norsk Hydro, with an ESG reach of 50%, which is significantly lower than their volume (64%). Constellium once again lags behind, with an ESG reach of just 40%, BUT it is closest to its volume (43%), showing good reach performance in comparison to their non-ESG content.

Conclusion: The double-edged sword of ESG in aluminium

ESG communication is both an opportunity and a challenge for the aluminium sector. On the one hand, companies are succeeding in making sustainable development a central element of their narrative, as evidenced by the considerable volume of ESG content. On the other hand, the low engagement and reach figures suggest that it's not enough to have a lot of publication on ESG, but there is a need to try and design meaningful campaigns to engage and reach stakeholders, and that these campaigns need to be evaluated and monitored.

For ESG to have real impact, it needs to be authentic, engaging and aligned with stakeholder expectations. The aluminium sector's ESG communications journey provides a valuable case study, not just for heavy industries, but for any company seeking to build a sustainable brand.

Key Topics analysis

Now let’s dive together into the topic analysis, to understand what the content is about!

In order to provide companies with a relevant topic analysis, we have decided to base our tool on the CSRD regulation. (to find out more about the CSRD, click here).

We have therefore separated the topics by ESRS and obtained valuable and actionable informations on how these themes are associated with companies in the aluminium sector.

90% of the brand’s online content are on three topics

The CSRD classifies ESG topics according to the European Sustainability Reporting Standards (ESRS), and our analysis reveals a dominant focus on three themes: E1 (climate change), E2 (pollution) and E5 (resources and circular economy). These three topics account for around 90% of each company's ESG online content, indicating a clear priority in the way stakeholders associate brands with sustainability challenges.

Stakeholder engagement and sentiment matrix by theme and company

Note: bubble size indicates volume; engagement is per post; sentiment is a ratio between positive and negative posts.

Novelis: high volume, moderate sentiment and varied engagement

Novelis leads the pack in terms of communication volume. Here's the breakdown:

-E1 (Climate change): With 7,619 posts, Novelis has a net sentiment of 24%, and engagement per post is 0.6.

-E2 (Pollution): Significant attention with 14,426 posts, but engagement per post is only 0.04, despite a stable net sentiment of 24%.

-E5 (Resources and circular economy): Highest volume with 16,949 posts, net sentiment of 22%, the best engagement per post amongst all the brands,1.17 .

Novelis E5 leads in terms of engagement, but it is still very low.

From data collected in other sectors, we know that in general and with the right strategy, E5 is an engaging topic of great interest to stakeholders. The engagement rate of 1.17 per post is good compared to the low overall engagement in this sector, but it can be increased considerably, and large business opportunities can arise from an increase in spontaneous engagement on E5.

Norsk Hydro: more balanced, very low engagement but high sentiment in climate change posts.

The outcome of Norsk Hydro's content is slightly different, with more balanced volumes and higher sentiment:

- E1 (Climate Change): 6,294 publications with net sentiment of 26% and low engagement per post of 0.04.

- E2 (Pollution): A notable 9,055 publications with low sentiment of 22% and engagement per post of 0.5.

- E5 (Resources and circular economy): A similar volume of 8,901 messages, net sentiment of 20% and engagement per post of 0.2.

Norsk hydro struggles in engaging their stakeholders. However the net sentiment for Climate Change topics is good.

Example of positive post that drove traction: an article in Yahoo Finance: "Hydro is shifting gear to capture opportunities created by increased demand for low-carbon aluminium [...] contribute to nature positive and a just transition, while shaping the market for greener aluminium." (you can access the article by clicking here)

Constellium's outcome is different: fewer posts, but achieves higher net sentiment, particularly in the climate change category, still poor engagement:

- E1 (Climate change): 1,500 posts with a net sentiment of 40%, the highest of all companies, but engagement per post is low (0.03).

- E2 (Pollution): 4,278 posts with a net sentiment of 29%, but engagement remains minimal at 0.016.

- E5 (Resources and circular economy): 4,194 publications, net sentiment of 22% and engagement per post of 0.04.

Once again, the engagement rate is very low, showing the lack of spontaneous interaction from stakeholders. However, net sentiment on posts is significantly better than that of the competitors. Particularly on E1, climate change, which represents a massive opportunity to generate more engagement in order to convert it into business opportunities.

What these figures tell us // Key takeaways

- High volumes reflect high stakes: The importance attached to E1, E2 and E5 reveals that stakeholders want information on these topics. They're posting and talking about these specific topics! We know now that climate, pollution and resource management are areas in which the stakeholders expect accountability.

-Sentiment and engagement gaps: Net sentiment is good in this sector, with no major risk that goes with negative net sentiment like greenwashing or fraud accusations. However, engagement is very low, showing that it is necessary to leverage good stakeholder sentiment into action! This represents massive opportunities.

-The circular economy opportunity: The relatively higher engagement to E5-related posts can be exploited. Almost all industries are increasingly interested in circular economy practices. This is a trend worth noting. Aluminium, known for its recyclability, has a strong history around resource efficiency, and companies that can highlight this aspect effectively may find a receptive audience.

- Most online discussions focus on environmental issues; social aspects need to be developed further, and opportunities may arise, such as talent acquisition and retention, improved brand image, attracting socially conscious customers.

How Can My Company Improve Sustainability and ESG?

At NBS factory, your reputation matters. We align your ESG actions with the perception of your stakeholders for better business performances.

We provide:

- Diagnostics based on historical online data (social network, digital media).

- Continuous & real time monitoring of ESG conversations online, helping to uncover weak signals (risks and opportunities).

- Engagement measures, which can be used to answer CSRD relative topics, but primarily to highlight spontaneous topics creating positive engagement, thus opportunities for business.

- Alerts about key focused ESG topics and identified risks for a brand.

- ESG trainings including how to avoid greenwashing or stereotypes within communications or marketing materials.

We're here to support you, send us an email now hello@nbs-factory.com or click here 👉 to request a demo