Understanding Cognitive Biases: How They Shape Our Decisions

Explore the hidden mental shortcuts that shape our judgments and decisions. From overconfidence to the framing effect, cognitive biases influence how we perceive, remember, and respond to the world. Understanding these biases can help us make more informed and rational choices in both personal and professional life.

What’s an example of cognitive bias?

The Bat and Ball Problem from Daniel Kahneman’s, Thinking Fast and Slow⚾🏏

A bat 🏏 and a ball 🥎 together cost $1.10. The bat costs $1.00 more than the ball. How much does the ball cost?

Our first instinct was to say $0.10, don’t worry — most people think the same! But that answer is actually wrong due to a cognitive shortcut known as System 1 thinking.

System 1 thinking is the fast, automatic part of our brain that jumps to quick conclusions without deep analysis. It’s great for snap decisions, like dodging a ball or reacting to danger 🏃♀️💨, but it can be misleading for more complex problems. In this case, System 1 leads us to a seemingly simple answer — subtract $1 from $1.10 and conclude that the ball costs $0.10. But that doesn’t hold up under closer scrutiny.

To find the real answer, we need to engage System 2 thinking, which is slower and more analytical 🧠🔍. Let’s break it down:

If the ball costs x dollars, and the bat is $1.00 more, the bat costs x + $1.00. Together, the bat and ball cost $1.10, so:

x+(x+1)=1.10x + (x + 1) = 1.10x+(x+1)=1.10

Simplifying this equation gives us x = 0.05. So, the ball actually costs $0.05, and the bat costs $1.05 — a total of $1.10.

While System 1 is great for quick decisions, it often oversimplifies complex problems. System 2 takes more effort but leads to the correct answer. 🔄✨

Types of Cognitive Biases

🤯Overconfidence Bias

Overconfidence bias is the tendency to overestimate one's abilities, knowledge, or accuracy in predicting outcomes. This can lead to poor decision-making due to underestimating risks and ignoring important information.

A cat seeing its reflection as a lion is like a person with overconfidence bias thinking they’re a karaoke superstar 🎤, even though they’re actually just screeching like a cat 🐱!

📅Availability Bias

The tendency to overestimate the likelihood of events based on how easily examples come to mind. For instance, people might think shark attacks are common because they remember news stories about them.

🔙 Hindsight Bias

The inclination to see events as having been predictable after they have already occurred. After an election result, for example, people might claim it was obvious who would win.

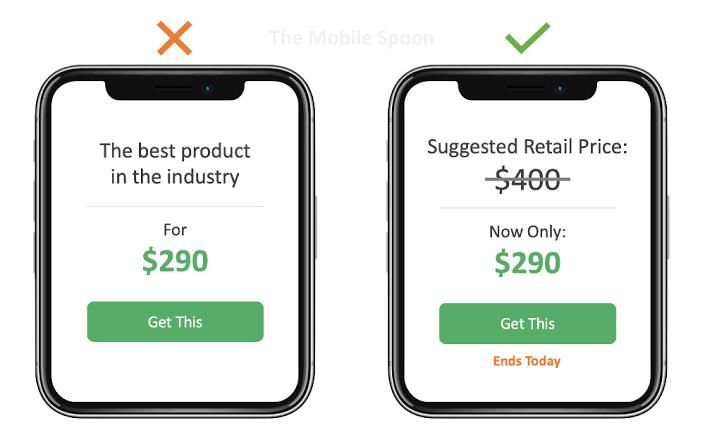

⚓Anchoring Bias

The common tendency to rely too heavily on the first piece of information (the "anchor") when making decisions. For instance, initial price offers can heavily influence the final negotiated price.

🖼️ Framing Effect

How people react to choices depends on how they are presented. For instance, more people will opt for frozen yogurt if told that it is “80% fat free” rather than “contains 20% fat”.

💸 Sunk Cost Fallacy

The idea that one should continue an endeavor because of previously invested resources (time, money, effort), not because of potential future returns. It’s why people might finish a bad movie just because they’ve already paid for it.

Cognitive Biases in Investing

✈️Representativeness Heuristic + Availability Bias

Example: Linda problem (Judging likelihood based on stereotypes). Investors might assume male entrepreneurs are more successful due to more visible examples, potentially skewing their investment decisions.

🔄Similarity Bias + Overconfidence Bias

Example: Investors often prefer startups led by individuals who resemble themselves, possibly due to an unconscious bias. There's a tendency to undervalue the potential of entrepreneurs from minority groups who don't fit certain stereotypes.

🔍Confirmation Bias + Hindsight Bias

Example: Post-investment, investors may remember instances of failure more prominently if they involve female-led teams, due to these teams being less common and therefore more memorable. This can skew the evaluation of investment decisions, focusing more on confirming pre-existing beliefs rather than objective analysis.

Conclusion

Addressing cognitive biases through education and awareness is essential for promoting fairness and inclusivity in decision-making, whether in the workplace, investing, or other areas of life. Recognizing and actively working to overcome these biases helps create a more equitable environment that values merit and reduces the influence of unconscious prejudices. Implementing corrective measures, such as anonymizing job applications, also minimizes bias at its source and ensures decisions are based on objective criteria. These efforts lead to more just and informed outcomes for individuals and organizations alike.

At NBS factory, we think it is important to highlight and educate on various cognitive biases and their impact on climate action, DEI, and other critical areas. 🌍✨

Interested in understanding how your company’s ESG activities are perceived? Reach out to us at hello@nbs-factory.com. 🔍📧

FAQ's ❓

What is cognitive bias?

A cognitive bias is a systematic pattern of deviation from rational judgment, often resulting in illogical or irrational decisions and perceptions.

Who coined the term cognitive bias?

The term was coined by psychologists Amos Tversky and Daniel Kahneman in the 1970s.

What is the Linda problem?

The Linda problem is a cognitive bias scenario created by Tversky and Kahneman to study decision-making, illustrating the conjunction fallacy where people erroneously believe that specific conditions are more probable than a single general one.

What are some common types of cognitive biases?

Some common cognitive biases include availability bias, hindsight bias, anchoring bias, framing effect, sunk cost fallacy, and attribution bias.

How do cognitive biases affect investing?

Cognitive biases can influence investment decisions by causing investors to rely on stereotypes, prefer familiar types of leaders, and remember failures disproportionately based on pre-existing beliefs. Understanding these biases can help mitigate their impact on investment choices.

Can cognitive biases be completely eliminated?

While it's challenging to completely eliminate cognitive biases, increasing awareness and understanding of these biases can help individuals recognize and manage them. Using structured decision-making processes, seeking feedback, and considering alternative viewpoints are effective strategies to reduce the impact of cognitive biases.

Why is it important to understand cognitive biases?

It is important to understand cognitive biases because it helps individuals make more rational and informed decisions. Recognizing these biases can help people improve their critical thinking, reduce errors in judgment, enhance problem-solving skills, and foster better interpersonal relationships.